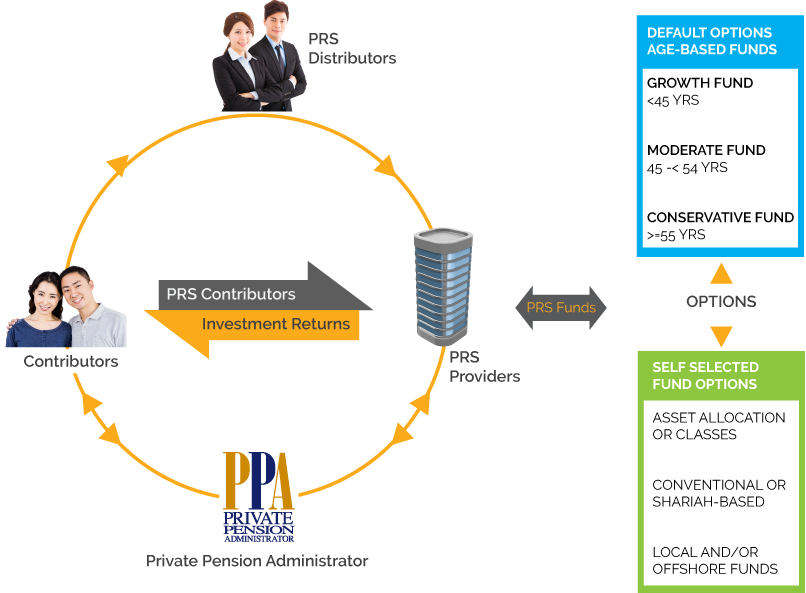

A voluntary investment scheme initiated by the Government to help Malaysians accumulate savings for a sustainable retirement income. A Private Retirement Scheme PRS is a defined contribution private scheme that complements the Employees Provident Fund EPF and other retirement plans on a.

Structure Of Prs Private Pension Administrator Malaysia Ppa

The Private Pension Administrator Malaysia PPA is the central administrator of the private retirement scheme and they are responsible for managing your account and facilitating transactions.

. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to voluntarily supplement their retirement savings under a well-structured and regulated environment. The PRS was launched in July 2012 with the objective of offering Malaysian employees and the self-employed an additional avenue to save for their retirement. Introduced by the government to help encourage long-term retirement savings PRS is meant to assist you in later years to not rely on just EPF alone.

A voluntary long-term investment scheme designed for all individuals aged 18 and above who are either employed or self-employed to accumulate savings for retirement. Lets take a look at why you ought to consider saving for retirement with this scheme. Priv ate Retirement Scheme.

Find out more about PRS here. PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion.

Under PRS an individual can plan for their retirement better through various PRS funds according to their risk and return profile. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Covid-19-related withdrawals over the past two years have had a massive impact on the savings of Employees Provident Fund EPF contributors as currently only 3 of contributors can afford their retirement says Nurhisham Hussein.

Were finding many consumers need help with ensuring they have saved enough to have the retirement lifestyle they dreamed of and these funds are a perfect complement to your Employees Provident Fund EPF member savings. Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. You are allowed to claim up to RM3000 for PRS contributions each year for a total of 10 years.

4 rows Initial investment of RM1000 and a minimum of RM100 in subsequent contributions. If you are an EPF member the. The user should seek personal advice from their PRS Consultant for their own personal situations or circumstances.

If you are eligible to pay taxes you may be interested in the fact that contributions made to your PRS account can be claimed for taxes. If yes you may want to consider investing in a Private Retirement Scheme PRS. Aims to provide both employees and self-employed individuals with an additional avenue to save for their retirement.

Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your. Sebelumtu biar kita jelas apa itu Private Retirement Scheme PRS. If you are an EPF member then PRS can complement your EPF savings.

A PRS is a voluntary scheme designed to help individuals accumulate savings for retirement. It is open to foreigners residing in Malaysia as well. Home Individual Investors Private Retirement Scheme.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Private Retirement Scheme PRS was introduced as an initiative to accelerate ones long-term retirement savings. It is an additional way to boost total retirement savings whether you are an Employees Provident Fund EPF member or not.

Money in PRS is. Only 3 of contributors can afford their retirement says chief strategy officer. With PRS you can plan your retirement better by increasing your savings on a voluntary basis through various PRS funds.

It is an additional way to boost total retirement savings whether you are an Employees Provident Fund EPF member or not. 8 rows PRS is a voluntary investment scheme to help you save for retirement. What you should know about the Private Retirement Scheme PRS New way to boost retirement savings.

Provides yearly individual tax relief of up to RM3000 for investors until 2025. PRS adalah satu pelaburan yang di jaga oleh creditorWOW rasa selamatkan duit yag. It also offers an opportunity for employers to make additional voluntary contributions towards the.

What is a Private Retirement Scheme PRS. Siapa yang perlu ada pelaburan PRS ni. Kenanga Investors voluntary private retirement scheme complements the existing mandatory retirement savings scheme and.

Under the scheme you. Private Retirement Scheme known as PRS for short is a long-term savings plan which allows you to voluntarily contribute and build up your retirement fund. PRS is a voluntary scheme for all individuals who are 18 years old and above.

Private Retirement Scheme PRS Sign up for AmPRS online. Private Retirement Scheme PRS is a voluntary scheme that lets you take the lead on boosting your total retirement savings.

Prs Exceeds Rm5 Billion In Total Net Asset Value Businesstoday

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Taking Charge Of Your Retirement Is Good For You Prs Live

Private Retirement Scheme Prs 2017 Prs Youth Incentive Enhanced Features Pursuant To Budget 2017 The Prime Minister Had Announced That The Government Will Contribute Rm1 000 From The Existing Rm500

Structure Of Prs Private Pension Administrator Malaysia Ppa

Private Retirement Scheme Prs Facebook

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Private Retirement Scheme Principal Asset Management

What Is The Private Retirement Schemes Prs Prs Live

Principal Private Retirement Scheme Members Can Apply To Withdraw Cash Nestia

Prs For Self Employed Private Pension Administrator Malaysia Ppa

Finance Malaysia Blogspot How Private Retirement Scheme Prs Works Actually

Prs Private Retirement Scheme Home Facebook

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live